Comparison of perceptions in Canada and USA regarding cannabis and edibles | Journal of Cannabis Research

Characteristics of participants

The socio-demographics characteristics are reported for both jurisdictions as presented in Table 1. For the US, 52.04% of participants were females and 47.96% were males, respectively. In Canada, 59.51% were female, while the male participants accounted for the remaining 40.49%. Respondents were divided in three age groups: aged 18–34, 35–64, 64 + years. Respondents in the US were aged 18–34 years (29.61%), and the groups aged 35–64 years (43.86%) and 64 + years (22.92%) were similarly well represented. In Canada, respondents were, similarly, aged 18–34 years (35.37%), and the groups aged 35–64 years (41.42%) and 65 + years (23.21%) were similarly well represented as well. Also presented in Table 1 are comparisons for the sociodemographic characteristic for the population of cannabis users by country (Health Canada 2021; Jeffers et al. 2021). The unweighted data presented in this exploratory study falls into an acceptable margin of error for most of the sociodemographic categories for participants with a few notable exceptions within location. However, given the exploratory nature of the data and the stated limitations presented below, sampling bias should be modest within the study.

Acceptance and consumption

Regarding frequency of cannabis consumption, roughly 1 in 3 Americans who do consume reported they do so daily. In Canada, that portion was 25%. This difference was statistically significant (p < 0.001) Also of note was that 62% of US consumers reported they take cannabis at least once a week, while significantly, only 49% of Canadian respondents (p < 0.001) consume that frequently.

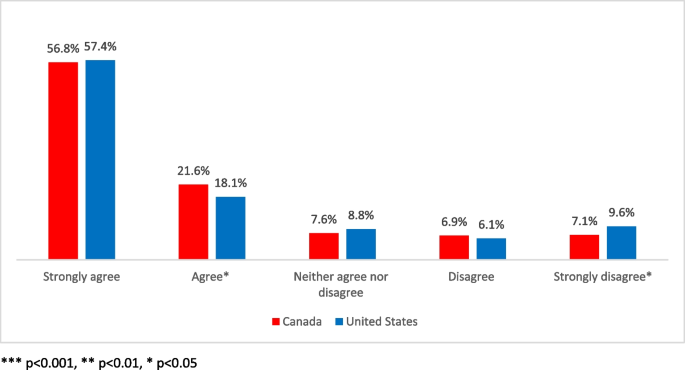

When asked directly if they support legalization of cannabis, a high percentage of Canadian and US respondents reported they do. Almost 8 in 10 Canadians (78%), and 3 of 4 Americans (75%), reported that they agree/strongly agree with legalization for recreational (adult-use) purposes. There was no statistically significant difference between these countries when it comes to acceptance.

Similarly, disagreement with legalization has declined to just under 16% in the USA and 14% in Canada (Fig. 1). Once again, no significant difference was present. Clearly, in both nations, the public has progressed beyond the tipping point and broadly accepts legal cannabis. However, that does not mean that a majority consumes cannabis or that illicit sources of cannabis are no longer a factor in purchasing behaviors.

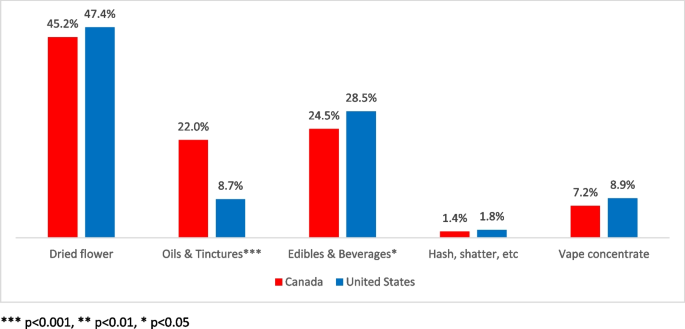

In terms of types of cannabis purchased, dried flower (bud) remains the market share leader in both nations (Fig. 2), with Canadian cannabis consumers preferring it marginally less (45%) than their American counterparts (47%).

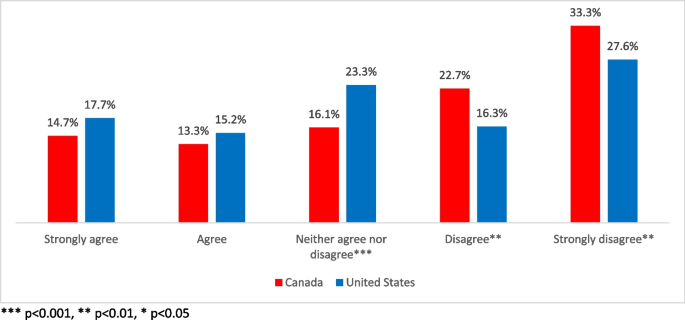

Indicative of possible future purchasing behavior, a substantial portion of respondents from both nations reported that municipalities should not be allowed to ban cannabis retail stores within their boundaries (Fig. 3). A majority of Canadian respondents (56%) agree or strongly agree that cities and towns should not be allowed to ban retailers; this was an almost total reversal of sentiment prior to legalization. Significantly, (p > 0.001) in the USA, 44% of respondents feel municipalities should not be permitted to ban cannabis stores.

In regard to the impact of COVID-19 on cannabis consumption, we uncovered measurable changes directly attributable to the pandemic. For example, just under one third of cannabis consumers in both countries reported they increased their intake of cannabis products between April 2020 and April 2021. When asked specifically about the impact of COVID-19, there was no significant difference between the two countries, with 14% of Canadian and 16% of US cannabis users reporting they consumed more during the pandemic.

On both sides of the international border, dried flower (or bud) was the format of choice for cannabis buyers: 45% of consumers in Canada compared to 47% in the USA (Fig. 2). As the responses reveal, interest in edibles (including beverages) was moderate in both countries, with almost 25% of Canadian consumers and just over 28% of American consumers reporting they prefer edibles. Interestingly, a significant difference exists between Canadian cannabis consumers (28%) than American (21%) report they do not buy edibles (p < 0.00).

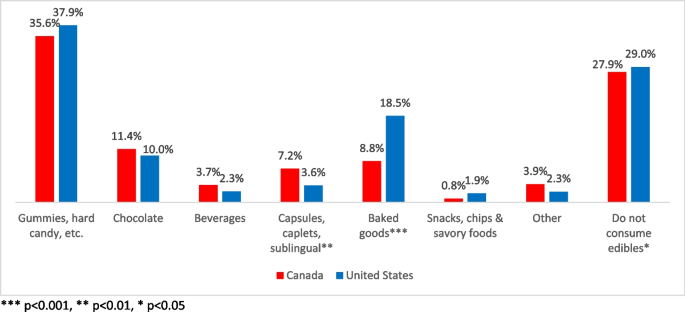

Within the edible category, gummies and other sweet confections (e.g., mints, hard candies) lead the way in terms of popularity in both countries (Fig. 4). Chocolates were preferred almost equally by Canadian (12%) and American (10%) cannabis buyers. Looking at other types of edibles yielded a few statistically significant contrasts: for example, 22% of Canadian cannabis consumers reported they preferred oils and tinctures compared to only 9% in the USA (p < 0.001). Baked goods are preferred by 19% of American cannabis consumers versus just 9% of those in Canada (p < 0.001). A statistically higher number of Canadians (p < 0.001), roughly 63%, remain anxious about the risks that cannabis (and its edibles) represent to children and young adults, whereas 51% of Americans are concerned.

When asked directly, a modest portion of cannabis consumers reported they intend to increase their purchases of edibles in the future. Significantly, about 21% of American buyers reported they will, compared to 13% of Canadian consumers p < 0.001). A substantial minority (over 28%) in each country are uncertain, significant for both countries.